Investing in Emerging Technologies – Opportunities and Risks

Investing in emerging technologies is one of the best ways for organizations to realize business benefits and achieve innovation goals. These technologies can include new technology fields or converging technologies that represent previously distinct systems moving towards similar goals.

Investments in emerging tech companies require risk capital and have a high probability of loss. However, the market environment is no longer friendly to capital-hungry tech stocks.

1. Understand the Technology

Emerging technologies have the potential to revolutionize industries and change how companies operate. They can bring business new capabilities and open up opportunities to grow revenue, increase efficiency and gain a competitive advantage. However, emerging technologies are also highly disruptive and can introduce risks that are difficult to predict.

Understanding how to invest in emerging technologies requires an open mind and a deep understanding of how these powerful tools can transform businesses. C-suite leaders play a critical role in identifying opportunities to leverage emerging technology for increased productivity, customer experience and overall business success.

What defines a technology as “emerging” is not widely agreed upon, but some common attributes include radical novelty, rapid growth, high coherence and prominence in the socio-economic domain(s). The emergence phase may last for up to 10 years, during which time it is subject to a number of different boundary conditions that will determine whether the technology becomes established or obsolete.

2. Research the Company

Investing in emerging technologies is a high-risk and potentially rewarding venture. Many of these new industries have high growth potential and can provide significant returns on investment. But it is important to do your research before investing in these technologies.

Performing quantitative analysis to understand key metrics is a good place to start when researching a company. This includes evaluating the financial performance of the company, including return on equity and return on assets. It is also helpful to compare these metrics against industry averages and other companies in the same business.

You should also research the company’s leadership team and its management capabilities. This research should include examining the background and management style of each leader as well as any past issues that may raise red flags. Additionally, you should try to identify a durable competitive advantage (sometimes known as an economic moat) in the company’s business model. This can come in the form of a strong brand name, patents, or a large distribution network.

3. Find a Technology Investment Management Firm

After a tumultuous 2022, investors are regaining confidence in technology’s potential to catalyze progress in business and society. Generative AI has been a leading driver of this revival, but many new advances are also on the horizon.

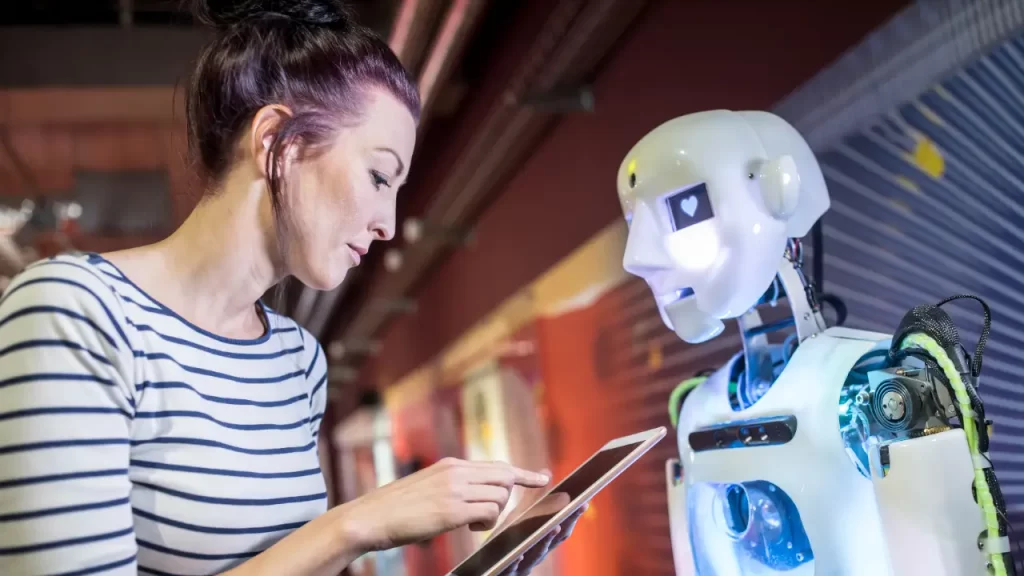

These technologies include blockchain (which could help automate and extend asset management business processes) and the Industrial Internet of Things, which enables companies to digitally manage, monitor and analyze physical assets. Other exciting emerging technologies are robotics and advanced materials.

Investing in these technologies is a big commitment, but it can yield significant growth opportunities. Asset managers should consider finding a technology investment management firm that specializes in these areas and can provide support for implementing these technologies into their business models. The right partner can ensure that the new technology ecosystem is secure, scalable and operationally resilient. This allows asset managers to focus on innovation, growth and client service. They can also stay competitive by leveraging the latest technologies to widen their advantage over their peers.

4. Make the Right Decision

Many emerging technologies require significant capital investments to develop. As such, they have a high risk level for investors. However, they can also have a high return on investment when they succeed.

As a result, investing in emerging technologies can be a great way to improve a company’s competitive advantage. However, it’s important to make sure that you choose the right technology for your company. Choosing the wrong technology can have serious consequences.

As a result, it’s essential to find a technology investment management firm that has experience with emerging technologies. They can help you identify the best opportunities and minimize the risks. This is especially important as companies face ever-changing business conditions. These changes include increasing stakeholder demands, uncertain economic conditions and new regulations. In order to meet these challenges, many organizations are turning to emerging technologies. These technologies offer a number of benefits, including cost savings and improved customer products and experiences.